According to the European Commission’s 2018 Digital Index, the Nordic countries are the best-performing countries when it comes to digitisation. This is a trend, which is reflected in our customers’ adoption of mobile and digital banking solutions as their main point of contact with us.

From 2015 to 2018, we saw an increase in the number of self-service eBanking transactions from 17.7 million to 50 million, and self-service mobile and tablet banking transactions rose from 10.8 million to 51 million. In the same period, the number of ATM transactions decreased from 43 million to 32 million.

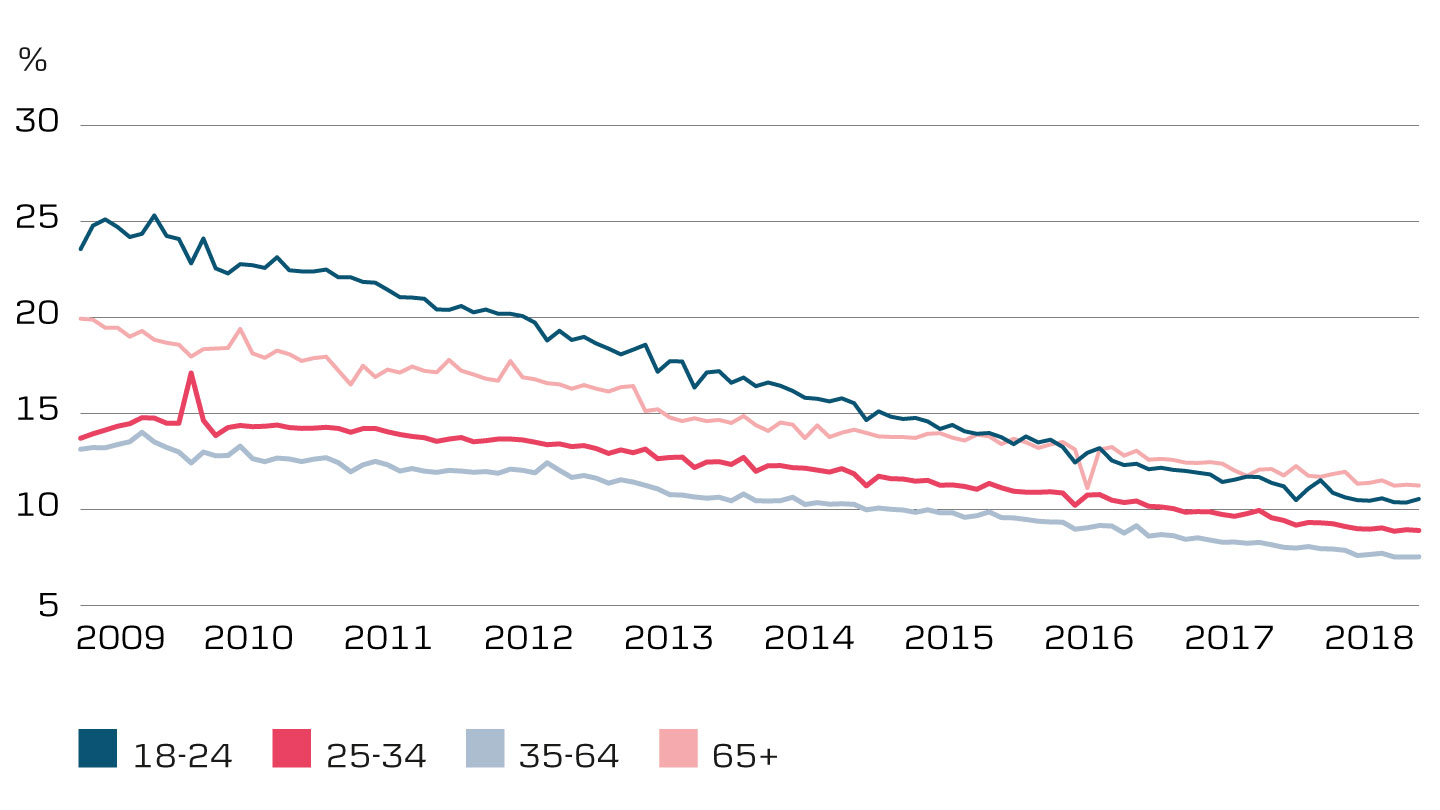

Dramatic drop in cash payment among young people under the age of 25

The number of cash payments is in decline. This is due to the increase in card payments and the use of services such as MobilePay.

Today, cash payment represents only 8% of total expenditure in Denmark compared to 2009 where the share was 15%. The most dramatic drop in cash payment is seen among young people under the age of 25, although the use of cash by seniors has also decreased and is today in line with other age groups.

Cash payment in DK - share of total expenditure