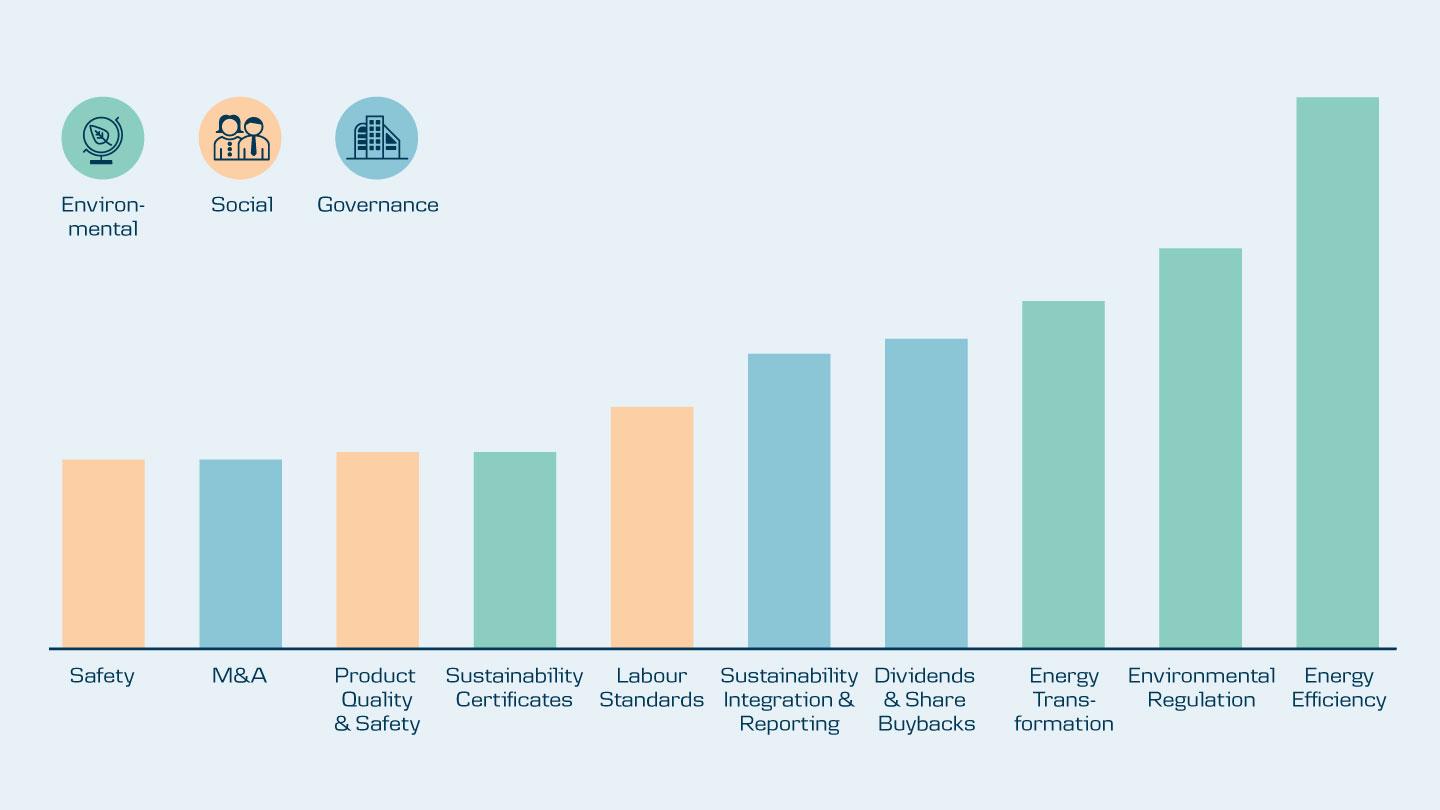

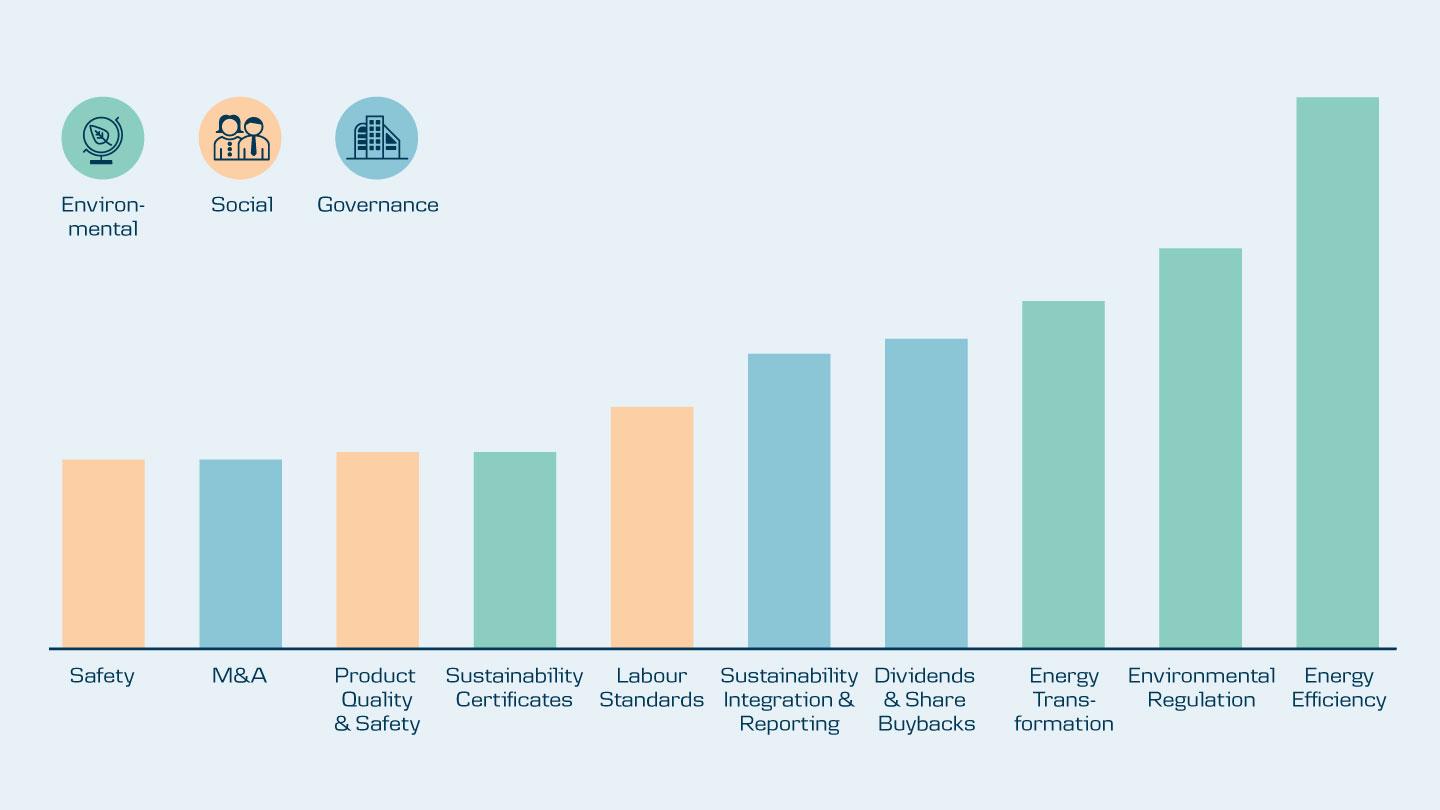

Most frequent ESG topics discussed

Content is loading

Content is loadingDanske Bank has just launched the 2018 report about our active ownership. It shows that energy related matters were the most frequently discussed with the companies, in which we invest.

Clean energy production is increasingly becoming a focus point for society and customers around the world and those companies that embrace the transition are more likely to outperform from an investment perspective. In addition to identifying investment opportunities, we are also in dialogue with portfolio companies to improve their ESG performance thereby influencing portfolio companies to not only mitigate ESG risks, but perhaps more importantly, to unlock opportunities that might otherwise be foregone.

Kasper From LarsenSenior Portfolio Manager and sector specialist for energy and utilities, Danske Bank.

What is active ownership?

Active ownership is the use of rights and position of ownership to influence the activities or behaviour of portfolio companies. Active ownership is regarded as one of the most effective mechanisms to manage risks, maximise returns and contribute to a positive impact on society. Active ownership is part of our fiduciary duty to customers to achieve the highest and most stable investment returns.

2018 report on active ownership

Dive into other insights in our full 2018 report on active ownership.