Sustainability could become a theme of great interest and offer attractive opportunities for return in the autumn, notes Danske Bank’s investment strategist, Lars Skovgaard Andersen.

“The UN’s sombre Intergovernmental Panel on Climate Change (IPCC) Report, released on 9 August, has reinforced the focus on the green transition, and the theme could enjoy further tailwinds ahead of the COP26 climate conference in early November. Furthermore, German parliamentary elections on 26 September could have sustainability as an area of political focus – not least after the catastrophic flooding in Germany in July,” says Lars Skovgaard Andersen.

Sustainability is therefore a theme he currently recommends investors to consider in their portfolios.

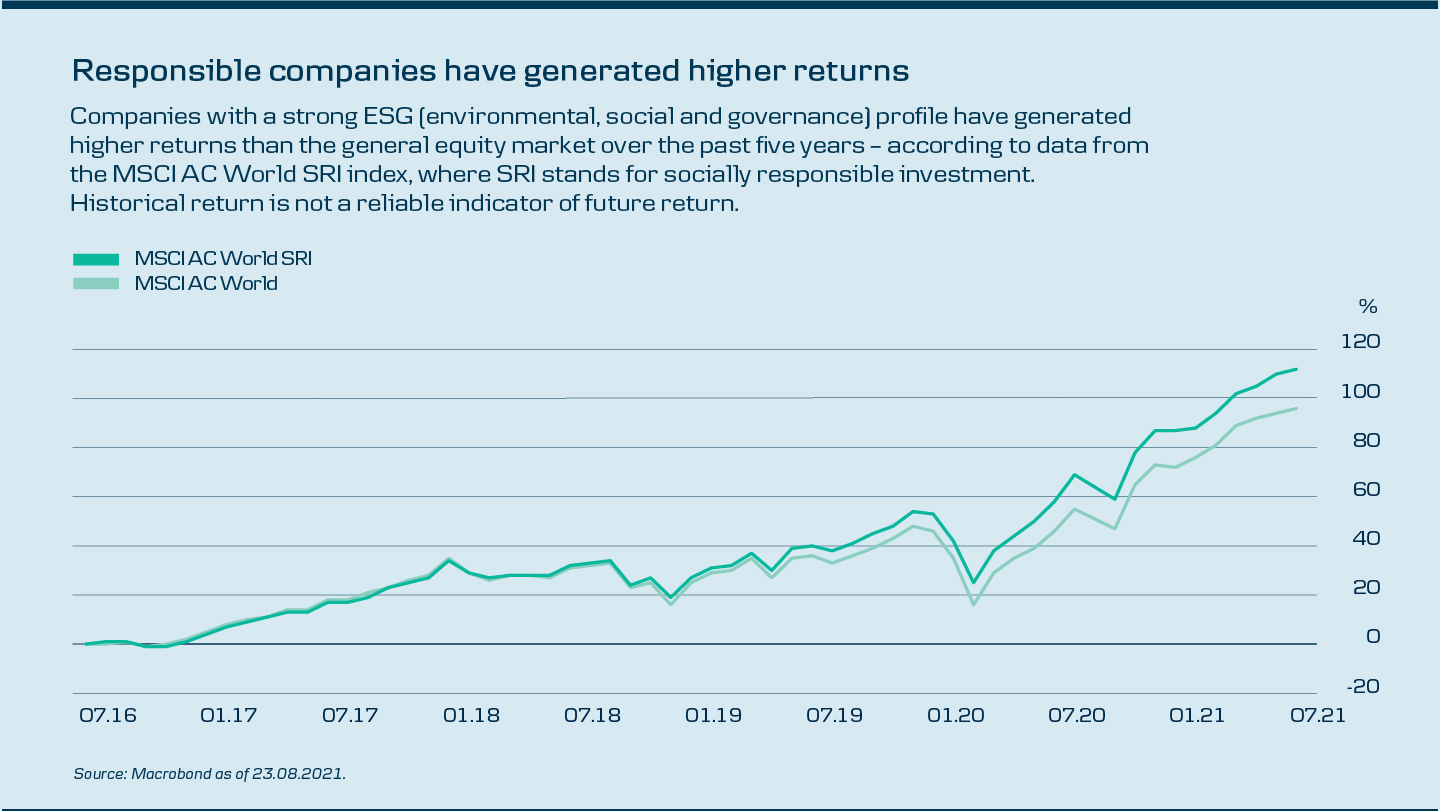

“I see a fair probability of sustainable equities and green themes outperforming the equity market in general this autumn,” says the investment strategist.

Green equities could experience tailwinds in the autumn

Sustainability may attract heightened attention in the coming months – both political and in the financial markets, estimates Danske Bank’s investment strategist.

.png?h=128&iar=0&w=128&rev=c0456076148343a69ec27218e9fa39aa&hash=5367D3AD7CFBE8E78181A6587FAB2790)