Fostering financial confidence in children

Pocket money presents itself as a good starting point for parents to begin talking about the important issue of money. According to the YouGov study, half of parents give pocket money specifically to help their children become financially responsible. Almost as many parents give pocket money to their children to teach them that money has to be earned by doing some work. This, however, is less true of parents in Sweden, who prefer to give pocket money to teach their children how to save up.

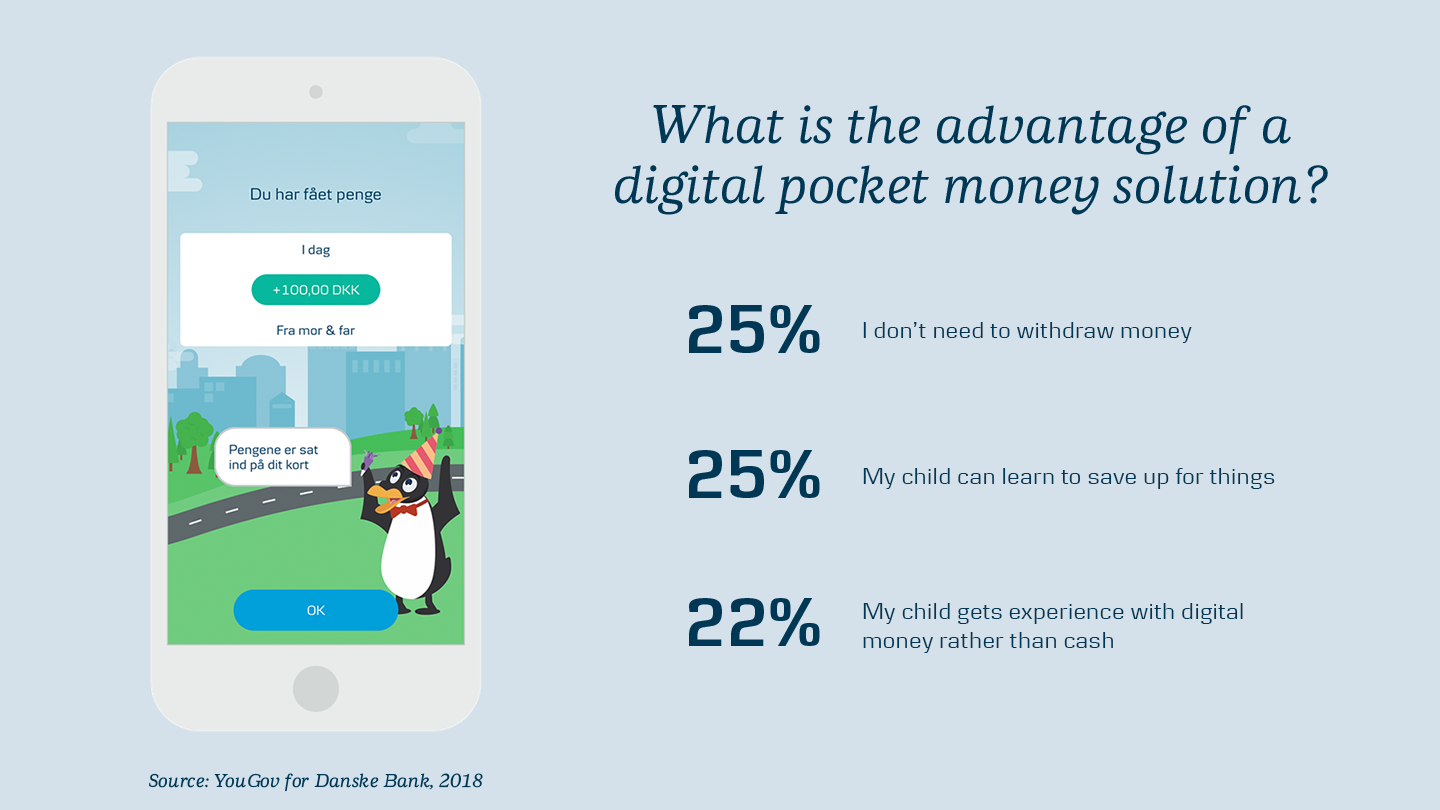

“Pocket money is a good place to start when it comes to parents talking to their children about the value of money and the importance of saving up. Moving towards an increasingly cashless society, it can be difficult for parents to give their children an understanding of money. That’s one reason why we’ve developed a digital pocket money solution that’s useful for parents and children alike,” says Dorte Eckhoff, who heads Danske Bank’s CSR programmes for children and young people.

Digital solutions gaining ground

Although digital pocket money solutions have yet to become widespread, it is clear from the YouGov study that parents stick with the solution once they have started using it. According to Dorte Eckhoff, this is evidence that the digital pocket money solution is addressing a real need.

“A lot of people no longer carry cash, which can result in pocket money becoming a bit of a random affair if it involves having to withdraw money first. This is where the digital solution makes things easier, whilst also giving both parents and children and overview of the pocket money given. As such, the digital solution is also a great tool for enabling parents to have regular discussions with their children about money, spending and saving up – all of which helps develop children’s understanding of money.”

What is Danske Bank's pocket money solution?

Danske Bank’s pocket money solution consists of three parts:

- a pocket money function for parents in the new Danske Mobile Banking app

- a separate pocket money app for children, where they can track their savings and spending

- a pocket money card.

More information about the pocket money solution on danskebank.dk