From the early 1960s and in the following decades, Danes transitioned from analogue and face-to-face banking services to digital tools – a development that has helped make us international heavyweights when it comes to digitalisation. To understand the process, we have to return to the swinging 1960s.

Photo: Danske Bank employee in the 1960s. Many manual processes are now undertaken using digital tools.

The machine that started changing the everyday lives of Danes

Banks were among the most curious about the new technology that emerged after World War II – and electronic data processing (EDP) was among the newest. Large machines could perform calculations and process data in a way and with a speed never seen before. Danske Bank caused quite a stir in 1963 when it switched on its brand new IBM machine. The computer replaced the manual and time-consuming processes associated with interest rate calculations and bookkeeping, etc.

More computers soon began to arrive, and their advent changed the workday of bank employees. Pen and paper were swapped for screens and keyboards.

Need for collaboration

By the end of the 1960s, several banks had developed their own IT systems, but the sector realised that each bank going in its own direction was not the best way forward. If the advantages of this new technology were really to benefit customers, common digital solutions for payment systems, etc. would be needed.

Jan Damsgaard, Professor at the Department of Digitalisation at Copenhagen Business School, here talks about the collaboration between Danish banks and how it contributed to Danes feeling secure about digital solutions early on:

Danes quick to adopt ‘Dankort’ and the ‘fly swatter’

In 1983, the popular chequebook got a competitor: With the launch of ‘Dankort’, Danes suddenly had their first digital payment card in their hands.

Danske Bank was one of the advocates for the new payment solution along with other banks. The new Dankort made everyday life easier for customers, who no longer needed to remember to have cash or their chequebook – or ‘pocket cheque’ as it was previously called in Denmark – with them when paying for everything from porridge oats to garden furniture.

When Dankort arrived in Denmark, it had to be run through a ‘fly swatter’ or credit card imprinter. The nickname derived from the swatting sound the machine made when taking an imprint of the card.

Photo: Cheques from the 1950s issued by Landmandsbanken (later Danske Bank), which introduced the chequebook or ‘pocket cheque’ at the start of the 1900s.

Photo: With the first many generations of Dankort terminals, you could only use the magnetic strip on the card. Since then, chip and contactless payments have come along.

Photo: ATMs at bank branches were introduced in the 1990s so customers could withdraw cash around the clock. Foreign currency withdrawals and cash deposits can now be made at many ATMs.

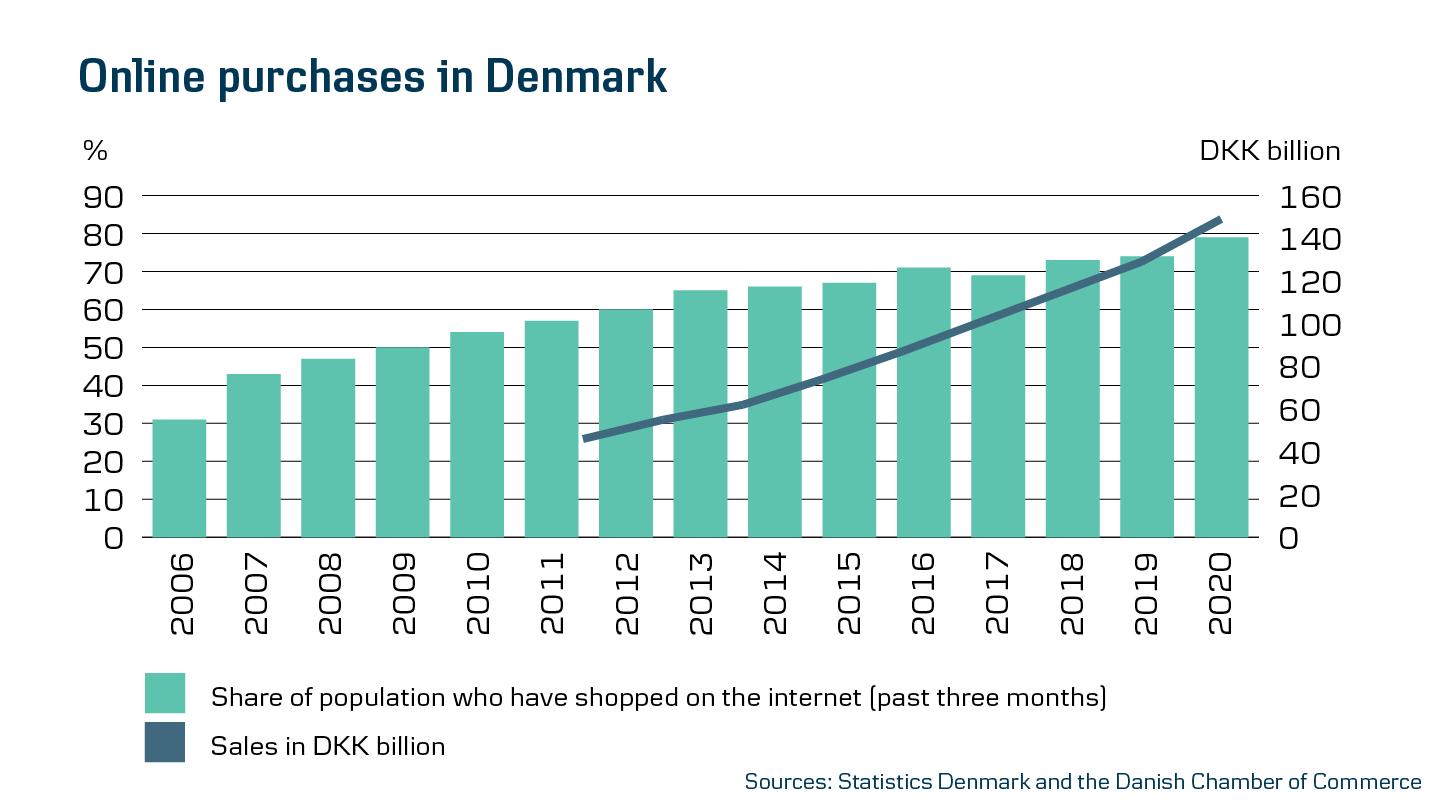

Dankort’s popularity rose steadily after its launch in 1983 and it quickly became the Danes’ preferred payment card. More and more bank services became digital as the internet spread from the 1990s onwards. In 1998, for example, Danske Bank’s customers were among the first in Denmark who could buy and sell financial securities online.

Dankort and the internet were closely linked as digital services developed, and Dankort played an important role in the spread of online transactions (e-commerce). Dankort was used for a webshop transaction for the first time in 1999.

To ‘swipe’ was at that point not yet part of the Danes’ vocabulary, but it later became the accepted term for paying and transferring money.

Your bank on your mobile

As the internet proved not to be the one-day wonder of rumour, Danes quickly began to expect new innovations.

There was a need for more flexibility, greater user-friendliness and better accessibility, for example in the interplay between consumers and companies across sectors. These needs grew among Danes as smartphones and tablets became an extension of their arm during the late 2000s and early 2010s.

With Danske Bank at the forefront, the banks developed online solutions and bank apps for both mobiles and tablets, and later Danske Bank’s mobile banking solution was awarded a global prize for best user experience. These digital solutions gave Danes better options for checking accounts, transferring money, paying bills, and much more – where and when it suited them.

Photo: Danske Bank launches District for business customers in 2020 – providing companies with an overview of accounts, transactions, liquidity and more, so the focus can be on their core business.

Photo: The introduction of eBanking allows customers to take care of their banking business from home or from the office.

Photo: Danes are quick to adopt MobilePay. In 2014, Dansk Sprognævn (Danish Language Council) recognises the significance of the new payment form by honouring MobilePay as Word of the Year.

In 2013, Danske Bank developed the payment app MobilePay in a development sprint of just six months.

The innovation process was intense and involved many of the bank’s employees and a number of partners, including the tech firm Trifork.

“MobilePay revolutionises and digitalises the Danes’ use of cash and in doing so turns upside down how we think and act in relation to payments. These types of technologies and solutions often only emerge from the tech giants, but MobilePay placed Danske Bank among the international heavyweights of groundbreaking innovators,” says Mark Wraa-Hansen, former CEO of MobilePay – now Head of Personal Customers in Denmark.

Just 10 weeks after the service was launched, 300,000 Danes had downloaded the new app, which satisfied a need among consumers they were barely aware they had. Now they could easily and quickly pay and transfer money to each other by swiping their smartphone. A few months later, it was also possible to use MobilePay in shops.

A race against time

Hear how Jens Peter Hedegaard, Vice President at Trifork, experienced the process, and what MobilePay means to him today both personally and from a broader perspective.

MobilePay truly turbocharged the process whereby bank customers could increasingly take care of everything themselves and everything could be done digitally. The following years saw the launch of one digital tool after the other - including

- WeShare (in Danish)

- June

- a pocket money app

All were characterised by the customer being at the helm and intuitively navigating through everything from shares to subscriptions.

In 2020, MobilePay had more than four million registered users (in Danish), and not even a global pandemic could put a damper on our money transfers.

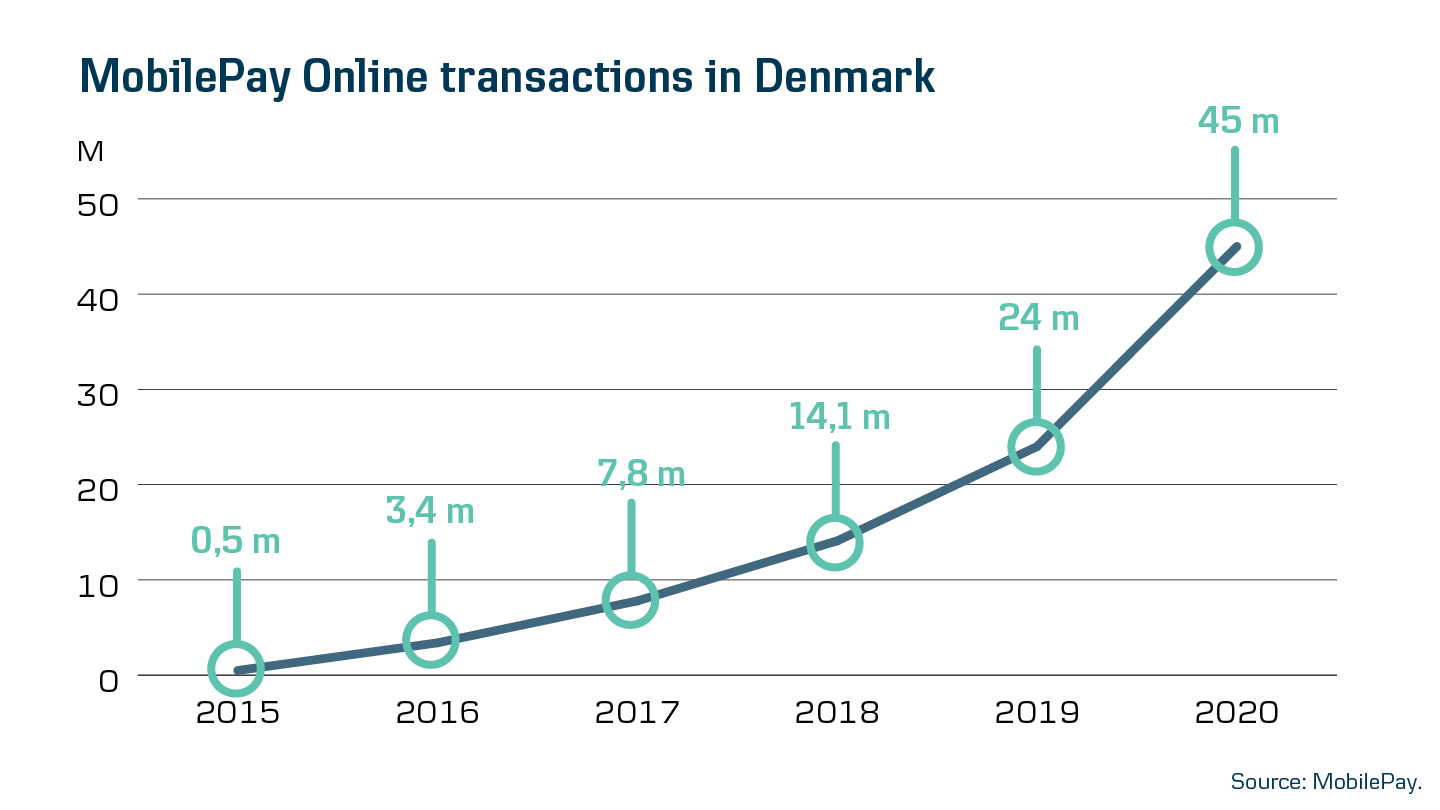

Almost one million transactions were made every single day in 2020, with the total transaction amount for the year standing at DKK 125 billion (in Danish), while MobilePay Online (in Danish) was used for 45 million transactions in 2020:

Here in 2021, MobilePay is on the threshold of entering a Nordic collaborative venture that will take the competition to the global tech giants in the payments area.

COVID-19 put the bank in people’s living rooms

COVID-19 made visiting your local bank branch more difficult, prompting a great need for customers to be able to meet the bank virtually. Hence, COVID-19 further accelerated the use of digital banking services by both ordinary Danes and companies.

This development also tied in with customers’ regularly changing needs and increasing use of the digital solutions that the financial sector provides:

“The banks have been good at placing a branch office in every home, in that we now have online meetings with our advisors, we have online banking on our tablets and we swipe pocket money payments via an app. Thus, the banks have moved right into Danish homes – up close to the customer. As consumers, we can service ourselves, but we also have a direct connection to the bank that we can make use of around the clock and from any location,” says Jan Damsgaard, Professor at the Department of Digitalisation at CBS.

The banks have moved right into Danish homes – up close to the customer.

Jan DamsgaardProfessor at the Department of Digitalisation, CBS

Pace of digitalisation does not appear to be slowing

Much has happened in terms of the Danes’ relationship to payments and banking services since the first EDP machines were taken into use. Yet, the type of collaboration seen with Dankort is still crucial if the banks are to help drive the digital development of society. Nowadays, that collaboration more comprises partnerships with Fintechs, who develop technology for the financial sector.

Working with Fintechs became possible because of an EU directive implemented in Denmark in 2018 that provided brand new possibilities for creating a better digital experience for customers.

For example, thanks to its partnership with Spiir, Danske Bank can offer its customers a feature that allows them to view their accounts with other banks directly in Danske Mobile Banking. This is known as “open banking” and means that, subject to giving their consent, customers can, for example, use financial services from other providers through Danske Bank’s online solutions. Or put the other way round: Use the apps of other providers to access data at Danske Bank.

Taking a very broad perspective, the financial sector’s funding of Denmark’s digital payment infrastructure has saved society billions of kroner (in Danish) annually.

One reason for this is that fewer resources are used on payments between households and companies when Danes use digital solutions from both the public sector and private companies – for example, mobilebank, payment apps and digital ID options, such as MitID.

So please keep swiping and scrolling – we have only just started.

Nordic bank innovation through the years

Sources and expert

Prepared with professional sparring from Jan Damsgaard, Professor at the Department of Digitalisation, CBS, and otherwise based on these primary sources: danskindustri.dk, Nationalbanken.dk, Finansforbundet.dk and Statistics Denmark