The company is now called Ancotrans and is run by Anders Nielsen’s great-great-granddaughter Anne Kathrine. The company still transports goods, but the customers are global and the routes have long since stretched beyond Valby Bakke.

Ancotrans’ story is closely woven into the history of how Denmark became an industrial society. And while industrialisation really took off in the twentieth century, we have to go back to Anders Nielsen’s time to discover what got it all started.

For entrepreneurs, the banks were an important player that made growth and expansion possible.

Martin Jes IversenEconomic historian and Vice Dean, CBS

A free hand at Holmens Kanal

At the end of the 1800s, business owners were building huge mechanised factories that produced large volumes of goods at lower prices than people were used to. Money was needed to invest in machinery, plant and new infrastructure. Hence, it was crucial for growth that business people could go to the bank and invest in new and modern technology.

“For entrepreneurs, the banks were an important player that made growth and expansion possible. Landmandsbanken – which we now know as Danske Bank – played a key role in the industrialisation process and functioned as a catalyst for modernisation in Denmark,” explains Martin Jes Iversen, who is an economic historian and Vice Dean at Copenhagen Business School:

The growing involvement of the banks and the great industriousness and entrepreneurship of the business community reached hitherto unseen heights in Denmark at this time. Regulation of the banks and companies was very lax and the banks could actually establish companies themselves.

Landmandsbanken, which was located at Holmens Kanal, supplied capital to both large and small private enterprises, and bankers were often involved in the running of several of the large companies. One company that started to flourish on the threshold to the twentieth century was the East Asiatic Company – also known as EAC (or ØK in Danish).

EAC opened the door to Asia

According to Martin Jes Iversen, the idea behind EAC was to get Denmark out into the world and connect Northern Europe with Southeast Asia – or more specifically Copenhagen with Bangkok – and it quickly took off. Just 15 years after its founding, the company had more than 4,000 employees, which was completely unheard of back then.

Martin Jes Iversen here explains more about how EAC set the agenda.

EAC shipped Danish goods to Asia and brought products from the East home to the Danes. And as Danish production picked up, so EAC’s activities rocketed. Optimism was so pervasive that when World War I hit trading activities in 1914, the expectation was that free trade would return to normal soon after the war. However, that is not quite what happened.

A cocktail of crises sinks the Danish economy

By 1922, Landmandsbanken was the largest bank in the Nordics, and had been supporting businesses with risk capital for many years.

However, not everything in the garden was rosy. Under cover of the feverish economy during World War I, many Danes started up businesses – and not all were equally sound. When the revolution in Russia pulled the rug out from under a number of Danish-financed companies in the 1920s, the house of cards almost collapsed.

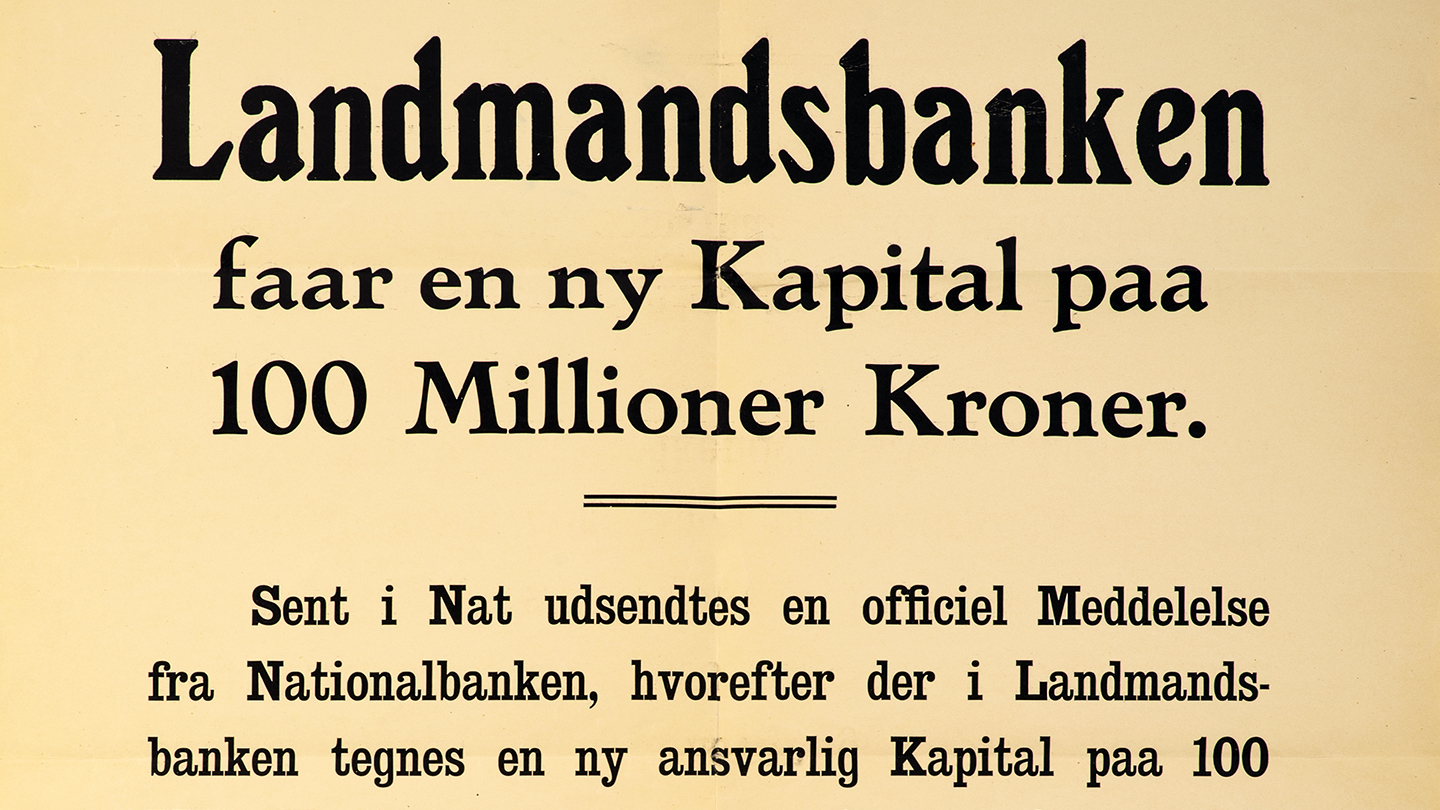

Landmandsbanken was close to bankruptcy, but was saved by the government and the central bank (Danmarks Nationalbank) on 5 February 1923, as many Danish businesses were dependent on the bank’s survival to be able to pull through themselves. In the subsequent fallout, several of the bank’s senior management were charged with fraud.

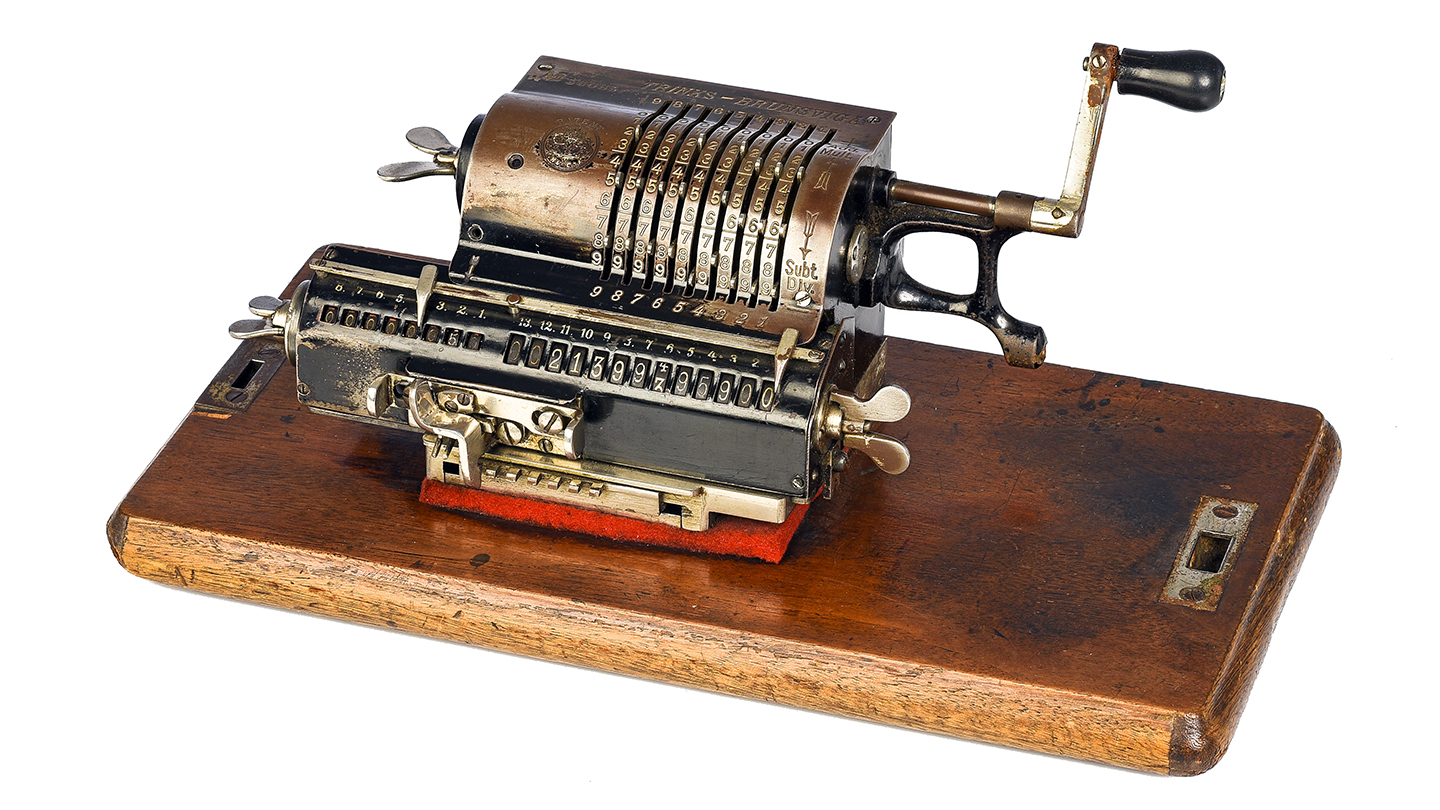

Photo: Before electronic calculators, old-fashioned mechanical calculators with a ‘crank’ mechanism were used for foreign currency calculations between the 1910s and 1960s. Here, an example from Danske Bank’s museum.

Photo: Office support staff from Danmarks Nationalbank cross the street with money for Landmandsbanken’s empty vaults the day after the reconstruction deal on 17 September 1922.

Photo: Original poster announcing government guarantee from Danmarks Nationalbank on 5 February 1923.

A further ingredient was added to the cocktail in 1929 with the Wall Street crash in the US, which triggered a worldwide economic crisis – also in Denmark. Unemployment grew, exports fell and the crisis squeezed the business community for the next ten years. In 1930, a new Bank Act introducing tighter regulation was passed by the government to restore the economy and ensure financial stability.

Hear Martin Jes Iversen talk about the beginning of this new era for the Danish business sector here:

Denmark flourishes despite international unrest and the oil crisis

Calm returned once more to the Danish business sector after the depression of the 1930s and subsequent regulation.

Ancotrans was one of the companies that could again look to the future. The company bought its first trucks to transport goods in the 1930s. And while World War II turned the world on its head, it had no great impact on business regulation here in Denmark. Ancotrans grew steadily as society and technology advanced in the 1950s, and the company’s last horses were sold off in the 1960s.

It was also in the 1960s that Denmark truly became an export nation, says Martin Jes Iversen: “‘Export Denmark’ arose in the 1960s. This was the age of industry. Development was supported by the banks, who helped companies finance their massive production plants.”

Export Denmark’ arose in the 1960s. This was the age of industry. Development was supported by the banks, who helped companies finance their massive production plants.

Martin Jes IversenEconomic historian and Vice Dean, CBS

Growing international trade made EAC the largest company in the Nordics in the 1970s in terms of both employees and revenue – larger than A.P. Møller-Mærsk.

The shift towards internationalisation was also something Ancotrans could sense, so they also moved beyond Denmark’s borders that same decade.

However, the strong economic growth suffered a serious blow from the oil crisis, which hit the entire world in 1973 and 1979.

Here in Denmark, fiscal policy was tightened substantially in connection with the so-called kartoffelkur – or ‘potato diet’ – in the 1980s, which made it considerably more expensive for individuals to borrow money for housing or private consumption. At the same time, however, the crisis years led to a liberalisation of the financial sector. The remit of banks was broadened so they could expand their business offerings to include insurance and mortgage lending.

Meanwhile, the European single market was taking shape, and competition from abroad intensified. Smaller banks feared they would be swept away by the large foreign banks in a market where only the strong would survive. This paved the way for the merger between Den Danske Bank, Handelsbanken and Provinsbanken in 1990.

Photo: CEO Knud Sørensen of Den Danske Bank knocks the first hole in the wall between Den Danske Bank and Handelsbanken – the two headquarters stood side by side – and then crawls through to be met on the other side by Handelsbanken’s CEO and the chairman of the board.

Martin Jes Iversen explains more about how the banks merged to match the international market:

From handcart to global logistics company

Nowadays, we take cross-border trade for granted. But if you ask Anders Nielsen’s great-grandchild and great-great-grandchild, they will confirm it takes time, hard work and a great deal of ingenuity to transform a firm based on a handcart behind Valby Bakke into a global transport company.

As in the 1880s, entrepreneurs and startups are just as crucial now for innovation, productivity and growth in our society, says Martin Jes Iversen: “When looking at entrepreneurship, you cannot turn a blind eye to the financial aspects – as this is extremely critical for entrepreneurs.” For entrepreneurs, startup capital is a necessary foundation for business development.

That is why Danske Bank, now as then, helps Nordic startups and growth companies achieve their breakthrough, grow and increase their positive impact on society. It all starts with one person with a single idea – and a bank that supports the development of that idea with startup capital.

That is the way it was back then, and this is the way it is today.

Sources and experts

Prepared with professional sparring from Martin Jes Iversen, economic historian and Vice Dean at Copenhagen Business School as well as Henrik Steenbjerge from Ancotrans, and otherwise based on these primary sources: lex.dk , danmarkshistorien.dk , Det produktive samfund and Wall Street-krakket i 1929