Investments: Goodbye to a decade – how will the next turn out?

Danske Bank’s investment strategy team take stock of the past decade in the financial markets and outline their expectations for the coming ten years.

Content is loading

Content is loadingDanske Bank’s investment strategy team take stock of the past decade in the financial markets and outline their expectations for the coming ten years.

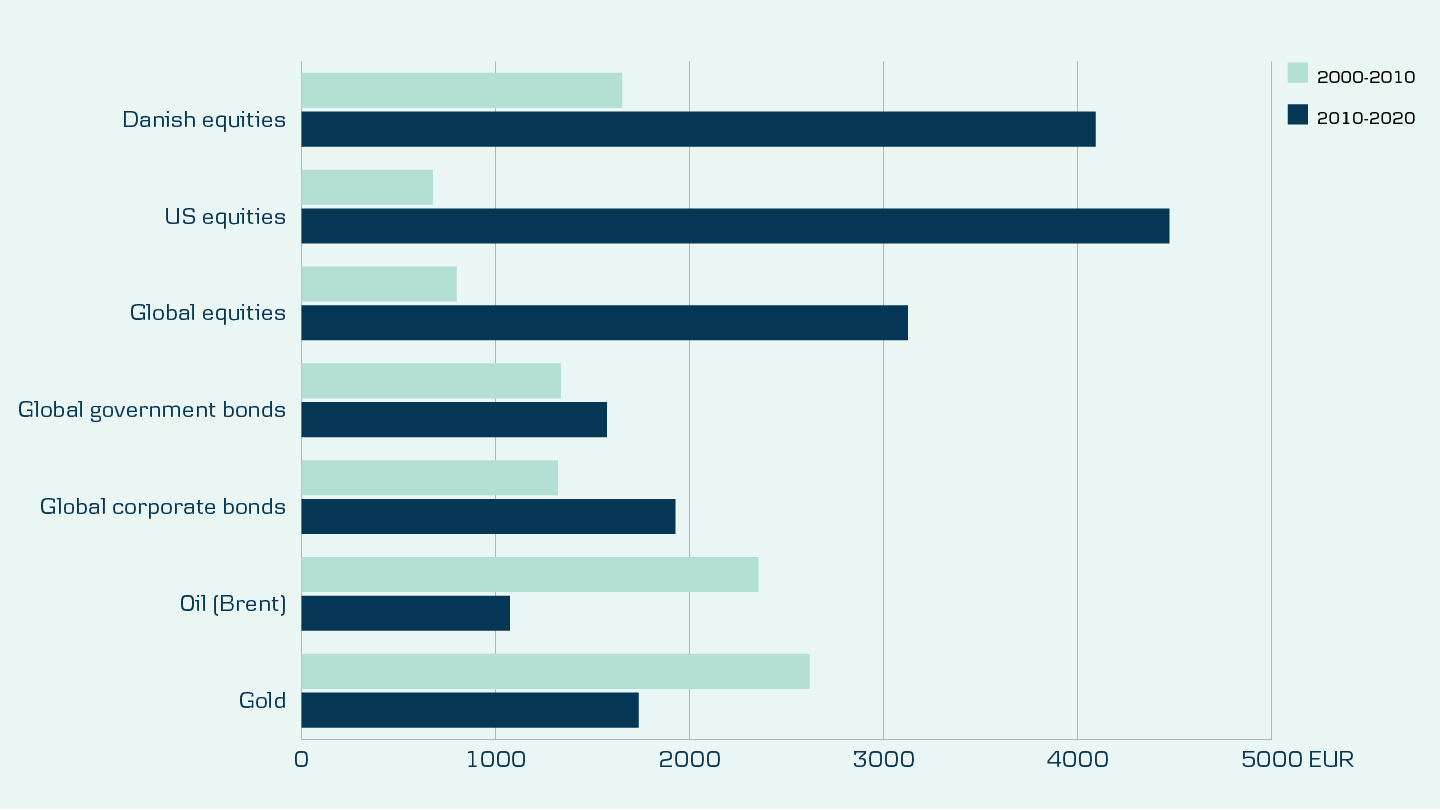

Global equities have generated an average annual return of 12.1%, with US equities in particular pulling higher – driven forward by digital giants like Amazon, Facebook, Apple and Alphabet.

Danish equities have given an annual return of 15.2%, with Novo Nordisk being a prime mover here. Part of the story, of course, is that equities got off to a flying start, as they were still in the midst of a rebound following the major price falls during the financial crisis.

When yields and interest rates fall, bond prices rise, so the declining interest rates of the past decade have therefore produced solid capital gains on bonds. On top of this come the regular interest or coupon payments, meaning global government bonds have given an average annual return of 4.6% overall, while the equivalent figure for global corporate bonds is 6.8%.

We are in the late phase of an economic upswing and will probably face a recession in the coming years. That is not necessarily a disaster for equity markets, but we should expect a setback of some sort, whether smaller or larger, before equities slowly but surely pick up and progress from there.

Henrik DrusebjergChief Strategist, Danske Bank

.png?h=128&iar=0&w=128&rev=c0456076148343a69ec27218e9fa39aa&hash=5367D3AD7CFBE8E78181A6587FAB2790)