As coronavirus, Covid-19, has thrown the world into a new, unprecedented crisis with great uncertainty about the disease as well as the epidemiological and economic measures taken to counter it, politicians, authorities and experts are tasked with making difficult decisions with little recourse to pre-existing evidence or data.

But for chief economist Las Olsen and his colleagues at Danske Bank, every day offers new data and information that little by little make them wiser about the crisis and its extent and character.

“We have started to get some more actual data on how the economy is affected by the coronavirus and the measures taken to counter it. As expected, it’s been a very hard blow, in Denmark and in the world around us”, says Las Olsen.

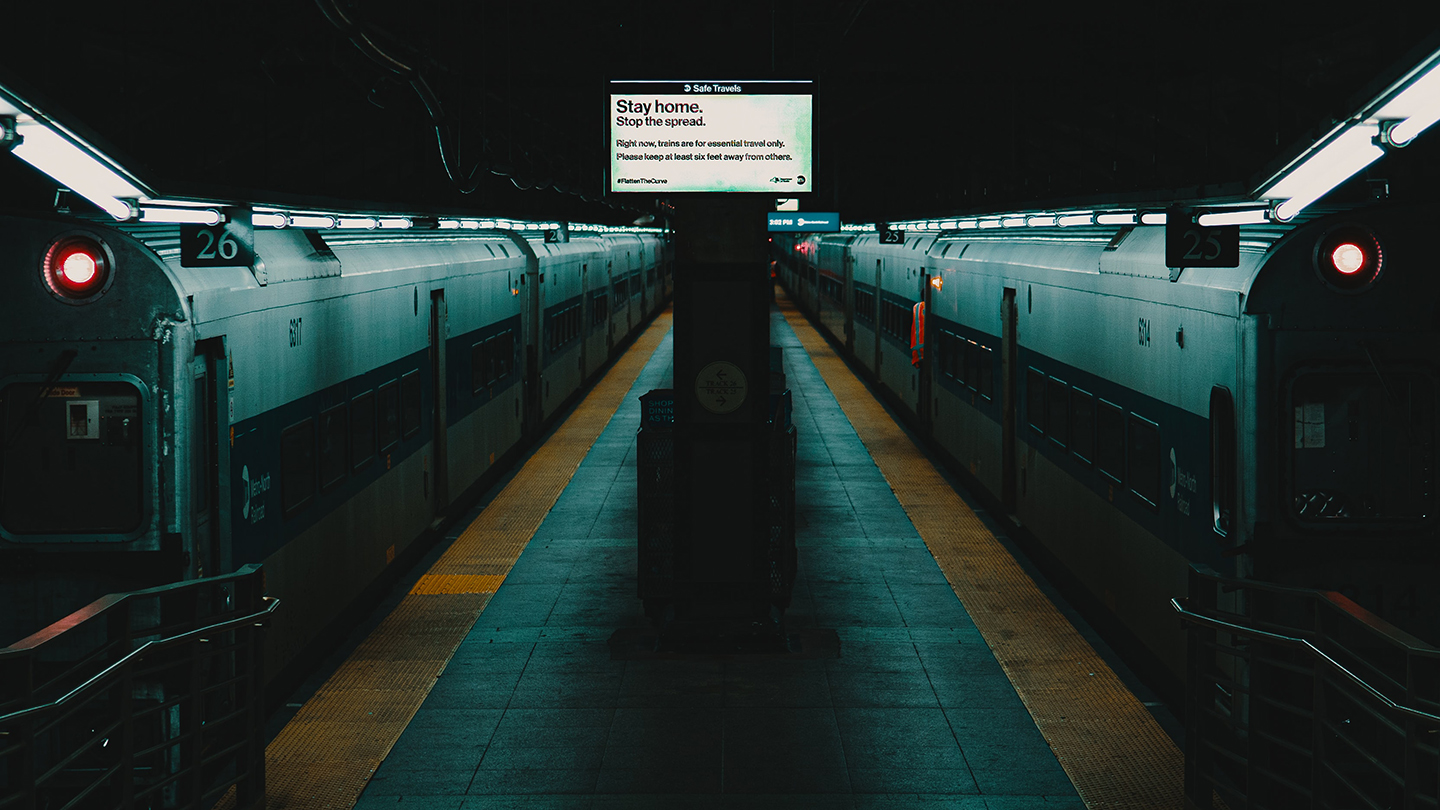

Image: Empty Grand Central Terminal, New York, USA during the corona crisis, Unsplash: Alec Favale

European companies hit hard

One set of data concerns business confidence among European companies, i.e. how these companies themselves assess the economic outlook. That figure is published every month, and the figure for March differs markedly from the months before, says Las Olsen:

“Although many places did not start to shut-down before the latter half of March, the numbers for the entire month indicate a two percent decline in gross domestic product for the entire first quarter. This is in the same order of magnitude as the worst time of the financial crisis, namely the first quarter of 2009. And we can expect the figure to fall even more in the second quarter. The numbers show that industry activity has been hurt but the service sector has completely collapsed with the biggest decline ever”.

Large increase in unemployment

In the United States, the spread of the virus and the closing-down of society has happened later than in Europe but here too - as elsewhere in the world - the economic damage is already exceeding the levels seen during the financial crisis.

"In the United States last week, there were 3.3 million newly registered unemployed - five times more than the worst week of 2009. Japan has postponed the Olympics and, according to the government, is experiencing economic damage similar to the financial crisis and the 2011 earthquake combined, says Las Olsen.

.png?h=128&iar=0&w=128&rev=c0456076148343a69ec27218e9fa39aa&hash=5367D3AD7CFBE8E78181A6587FAB2790)