As a large financial institution with activities across all economic sectors, our aim is to support our more than 3.2 million customers in their sustainability transitions. By providing finance when and where it is needed most, we can promote economic growth, jobs and prosperity while also enabling societies to transition to a more sustainable economy.

Our three strategic focus areas provide the framework for how we aim to create lasting value for our customers, for our business and for society:

Carsten EgeriisWe want to take responsibility for making a real difference in enabling this massive transition.

CEO, Danske Bank

See more

Customer offerings

We are committed to supporting our more than 3.2 million customers in navigating the transition toward a sustainable future by providing a range of sustainable finance advisory, products and services.

In focus

Danske Bank expands its tool box for financing the climate transition

Danske Bank partners with Position Green to strengthen ESG offering for business customers

Danske Bank and the Financial Sector’s Climate Partnership to accelerate the green transition with five concrete recommendations

Insights from engaging with more than 280 companies about nature and biodiversity

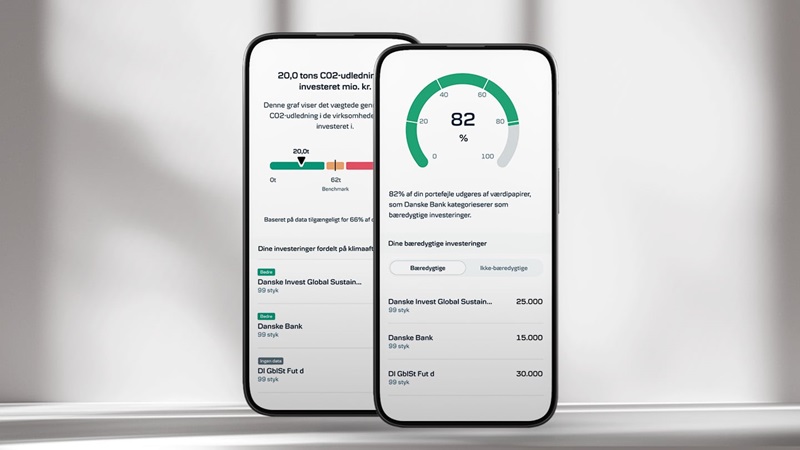

Danske Bank makes it easier to make sustainable investments directly in the Mobile Bank

Publications & policies

In our Annual Report, you can find our statutory sustainability statement, which provides information on our sustainability performance. In addition, you can find detailed and segmented data in our Sustainability Fact Book.

We continuously strive to develop and expand our reporting and disclosures, noting the growing importance of sustainability related data and information to our stakeholders.

-

05. feb 2026Climate Progress Report 2025

-

05. feb 2026Accounting principles and methodological considerations

-

05. feb 2026Danske Bank - Annual Report 2025

-

05. feb 2026Sustainability Fact Book 2025

-

03. aug 2025Human Rights Report 2024

-

30. jun 2025Statement on Modern Slavery 2024

-

20. jan 2023Climate Action Plan

-

20. maj 2025Our Approach to Financing the Climate Transition

.png?h=128&iar=0&w=128&rev=836db61059d3455582165769adce769e&hash=F1337267FA94E2448894244C8475028F)

Get in touch with us

We welcome any comments, suggestions or questions you may have regarding our work with sustainability.